![]() We believe that responsible investing in resources can play a key role in the transition to a more sustainable, low-carbon economy. That’s why we offer a range of responsible investment solutions designed to help investors support the transition to clean energy and steel production.

We believe that responsible investing in resources can play a key role in the transition to a more sustainable, low-carbon economy. That’s why we offer a range of responsible investment solutions designed to help investors support the transition to clean energy and steel production.![]()

This includes:

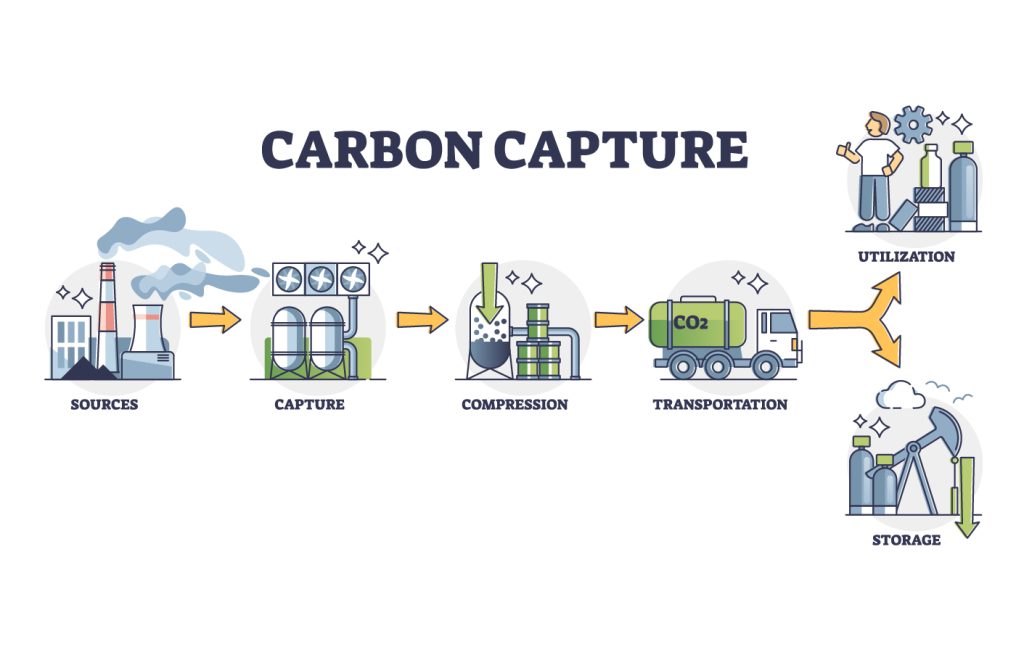

Carbon Capture, Storage and Green uses:

- Our clean coal technologies solutions focus on investing in companies that are leading the way in developing and deploying innovative technologies that reduce emissions.

- According to the Center for Climate and Energy Solutions, carbon capture and storage projects already operating in the United States are capturing over 90% of emissions from energy and industrial production.

- In order for 2050 carbon emission goals to be hit, emerging economies will be most in need of renewable and carbon capture solutions.

Sustainable Energy and Steel production:

- Our sustainable energy and steel production solutions provide a way for you to invest in companies that are developing new, sustainable methods for producing energy and steel, including renewable energy, carbon capture and storage, and electric arc furnace steel production.

- Investment in responsible resource companies that have a demonstrable track record in operating safely, with Environmental, Social and Governance policies in place and delivering early results. In particular, rehabilitation plans need to be above the minimum requirements, such as introducing carbon into soil for future farming, and native wildlife re-introduction and protection.

INSTITUTIONAL DEBT

Raise Capital and Grow Your Business

ASSET MANAGEMENT

STRUCTURED PRODUCT SOLUTIONS

DEBT RESTRUCTURING SOLUTIONS

INNOVATIVE FINANCIAL STRUCTURING

MULTIBILLION NICKEL MINING PROJECT

Arranging a series of investor roadshows to attract early stage capital through challenging financial markets and the investment of a total of over $50 million equity. A series of different rounds have allowed the company to continue towards construction and operations of this world class deposit, which will be amongst the largest nickel.

STRUCTURED $500 MILLION AVIATION

Financing of a Boeing 777P conversion programme to aircraft for freight to meet existing market shortfall through the issuance of $75 million in equity and $425 million in debt funding. The strong management team had the expertise to identify a gap in the market and take advantage by commercially developing the opportunity ahead of the competition.

PORT FACILITY $350 MILLION

Financing of one of South America’s largest deep water ports that was built to connect the coast with the major consumption and production centres offering container, dry bulk, coal and liquid terminals. The total construction was $875 million and our involvement was for 60% of the total debt financing component of this world class port infrastructure.

$600 MILLION WATER TREATMENT

Arranging the debt funding of this water treatment plant to complete the construction of the initial phase of development. After the project equity was raised we completed the debt funding allowing for the completion of the project that unlocked the potential for thousands of new homes and employment

ARRANGED PRIVATE FINANCE

Private financing and structuring of the sale of a corporate bond portfolio from a European client to a Singaporean investment company, via a major international bank. The client was seeking liquidity and anonymity from the wider market to ensure the highest price for the portfolio.

LITHIUM PROJECT

A North American junior miner, early stage equity raised $2M + $10M following round, listed on the TSX.